#Online Property Tax Bangalore

Explore tagged Tumblr posts

Text

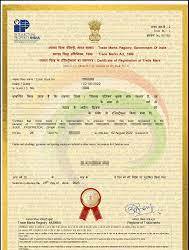

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

Buy Plots in Bangalore: Your Comprehensive Guide to Land Ownership

Dreaming of owning a piece of Bangalore? Imagine building your dream home, just the way you want it. Or picture your investment growing steadily over time. Bangalore's real estate market is booming, and plots are in high demand. This article will guide you through the process of Buy plots in bangalore, so you can make a smart investment and build the future you want.

Why Invest in Plots in Bangalore?

Land is a unique investment. Unlike apartments or villas, plots offer more flexibility and long-term growth potential. It's a chance to own something tangible, a blank canvas for your dreams.

Appreciation Potential

Bangalore's land values have been steadily increasing for years. Areas like Sarjapur Road and Devanahalli have seen huge gains. The growth is fueled by infrastructure projects and the city's expanding economy. Land often appreciates faster than other property types.

Flexibility and Customization

Want a garden? A pool? A unique architectural design? With a plot, you have the freedom to build exactly what you want. Apartments have limitations, but with land, your imagination is the limit. You get to create a home that fits your family's needs, both now and in the future.

Investment diversification

Investing only in stocks? Or just in apartments? Adding land to your portfolio can reduce risk. Land behaves differently than other assets. This is called diversification. It can protect your overall investment strategy.

Key Considerations Before Buying a Plot

Before you buy, take a step back. Evaluate some key things first. Location, budget, and legal checks are all key.

Location, Location, Location

Location is so important! Consider how close the plot is to schools, hospitals, and markets. Are there good roads? Are there future development plans in the area? Look at areas near the airport or metro lines. These can be good investments. The best plots in Bangalore provide easy access to everything.

Budget and Financing Options

Set a realistic budget first. How much can you spend? Then, check out loan options from banks and lenders. Remember to factor in extra costs. Registration and stamp duty can add up. Knowing your limit and costs will help you make smart moves.

Legal Due Diligence

Never skip this step! Check the land titles. Make sure the approvals are in place from BDA or BBMP. Get an encumbrance certificate. This shows if there are any outstanding loans. A lawyer can help you with this. Protect yourself from legal trouble.

Navigating the Plot Buying Process

Buying a plot involves some steps. Finding the right one, checking documents, and finishing the deal. Here's how to do it.

Finding Suitable Plots

Online portals like Magicbricks and NoBroker can help. Real estate agents know the local market. Visit the sites in person. Check the land's condition and surrounding areas.

Understanding Land Documents

The sale deed is key. It transfers ownership. The mother deed shows the history of the land. Property tax receipts prove taxes are paid. Get these checked by a lawyer.

Completing the Transaction

Sign a sale agreement. This outlines the terms. Then, register the plot in your name. Pay stamp duty and registration fees. Get legal advice during this process.

Top Locations for Plot Investments in Bangalore

Bangalore has many areas with good growth potential. North, South, and East Bangalore all offer opportunities. Here are a few to look at.

North Bangalore

Devanahalli, Yelahanka, and Hennur are growing fast. The airport and aerospace park are big drivers. Property values are rising. This area is becoming a major hub.

South Bangalore

Bannerghatta Road and Kanakapura Road are good choices. Connectivity is improving. Residential development is booming. Many people want to live here.

East Bangalore

Whitefield and Sarjapur Road are IT hubs. Infrastructure is good. Many tech workers want to live nearby. Land values are increasing.

Avoiding Common Pitfalls When Buying Land

Buying land can be risky. Be aware of potential problems. Avoid these common mistakes.

Fake Land Deals

Be careful! Some deals are fake. Verify all documents. Check with the authorities. If a deal seems too good, it might be.

Legal Disputes

Land disputes are common. Check the history of the land. Make sure there are no ongoing court cases. A clear title is essential.

Delayed Approvals

Approvals can take time. Check if the necessary approvals are in place. Delays can be costly. Ask about the status of approvals before you buy.

Conclusion

Investing in Plotted development bangalore can be rewarding. You get flexibility, growth potential, and the chance to build your dream. Do your research, get legal help, and avoid common pitfalls. Buying land can lead to long-term financial gains and personal satisfaction. Take the plunge, and secure your piece of Bangalore today.

0 notes

Text

A Comprehensive Guide to BBMP E-Khata: Simplifying Property Transactions with Khata Broker

In the evolving real estate landscape of Bangalore, property ownership and exchanges have become more streamlined and transparent. One of the fundamental steps in ensuring legal and authentic ownership is getting the BBMP E-Khata. This computerized change permits property owners and investors to securely keep up with and access essential property documents. If you are new to this or searching for a more efficient method for dealing with your property-related undertakings, Khata Broker is here to improve on the process.

In this guide, we'll walk you through the BBMP E-Khata process, the significance of the E-Khata certificate, and how Khata Broker can help with exploring these procedures effortlessly.

What Is BBMP E-Khata?

The BBMP (Bruhat Bengaluru Mahanagara Palike) E-Khata is an online system introduced by the Karnataka Government for keeping up with property records in Bangalore. It is a computerized type of the conventional Khata, which was required for registering properties, covering property taxes, and getting legal recognition. With the rise of advanced stages, BBMP E-Khata has made property management considerably more efficient, ensuring that property owners and stakeholders can access their documents online without hassle.

BBMP E-Khata is an essential step for property owners as it is currently mandatory to get the E-Khata certificate to process property charge payments, transfer properties, or engage in legal matters concerning the property.

Why Is the BBMP E-Khata Huge?

Understanding the importance of BBMP E-Khata is essential for anyone engaging in property exchanges in Bangalore. Here's the reason:

1. Online Access to Property Documents

With the BBMP E-Khata system, property owners can access their records carefully, eliminating the need for genuine document storage and huge delays at government offices. Everything can be easily accessed online, from charge details to ownership records.

2. Property Assessment Payments

An E-Khata certificate is indispensable for paying property taxes online. Without this certificate, you may be unable to pay your dues or make any legal exchanges related to the property.

3. Property Registration and Transfer

When exchanging property Bangalore, having the BBMP E-Khata simplifies the registration and transfer process. The system ensures transparency in ownership and prevents issues like illegal exchanges or fraudulent cases.

4. Verification of Property Ownership

Having an E-Khata certificate permits you to verify that you are the legal owner of the property. This certificate serves as evidence of ownership when applying for credits, permits, or other legal processes.

5. Legal Protection

Having your property registered with the BBMP E-Khata gives you legal protection against fraudulent exchanges. In case of disputes or suit, your E-Khata records will serve as a reliable source of information.

Steps to Apply for BBMP E-Khata

Getting your BBMP E-Khata involves a few essential steps. While the process is largely computerized, it really requires you to present a few necessary documents and information. Here's the manner in which you can apply for BBMP E-Khata:

Step 1: Visit the BBMP Website

The most essential phase in the process is to visit the power BBMP website (https://bbmp.gov.in/). You ought to navigate to the "E-Khata" section to begin the registration process.

Step 2: Register or Login

If you already have a record, essentially sign in with your credentials. In case you don't have a record, you ought to register by giving details, for example, your name, contact information, property details, and email address.

Step 3: Submit Property Documents

After registration, present the required documents for the BBMP E-Khata application. This normally includes the going with:

Title deed of the property.

Charge paid receipts (latest).

Approved building plan (if applicable).

ID and address verification, (for example, Aadhar card, visa, voter ID).

These documents are indispensable to verify the property's ownership and legality.

Step 4: Verify the Details

Once your documents are submitted, they will be reviewed by the BBMP authorities. The property will be verified for precision and authenticity. This step can take a few days to complete.

Step 5: Payment of Fees

After the verification, the BBMP will illuminate you about any applicable fees for the E-Khata certificate. Pay the fees online through the secure payment gateway provided on the entry.

Step 6: Receive the E-Khata Certificate

Once your payment is successfully processed, the E-Khata certificate will be issued carefully. You can download and store this certificate online for future reference or print it for your records.

Typical Challenges in the E-Khata Process

While the BBMP E-Khata system is designed to make property documentation easier, property owners sometimes face challenges in completing the process. Some of the ordinary issues include:

Inaccurate Property Details: If your property documents have discrepancies, for example, incorrect measurements or outdated information, it could delay the BBMP E-Khata registration. Ensuring that your documents are front line is huge.

Neglected Property Taxes: Accepting there are any remaining property taxes, you ought to clear them before applying for the E-Khata certificate. The BBMP won't process the application without charge clearance.

Incomplete Documentation: Accepting you neglect to present the necessary documents, the registration process will be stalled. Make sure you have all required paperwork in place to avoid delays.

Technical Difficulties: Some property owners could face challenges exploring the online entryway. In such cases, having the right assistance can be extremely helpful.

How Khata Broker Can Help with BBMP E-Khata Registration

At Khata Broker, we specialize in enhancing property-related services, consolidating helping our clients with BBMP E-Khata registration. We provide expert guidance and support to ensure that the process goes flawlessly with next to no disarrays.

1. Directing You Through the Documentation

One of the most complex aspects of the BBMP E-Khata process is gathering the correct documents. We guide you on which documents are needed, help you prepare them, and ensure everything is all together before convenience.

2. Document Verification

We help with verifying your property documents to make sure there are no discrepancies or missing details. This ensures that the registration process goes flawlessly with next to no delays or errors.

3. Filling the Online Structures

Wrapping up the online registration structures can sometimes be overwhelming, especially if you're interested about the entryway. Khata Broker helps you complete the online application and ensures every one of the details are correct before convenience.

4. Charge Payment Assistance

At Khata Broker, we help you in paying your property taxes online and make sure that all dues are cleared. This is basic in ensuring that your BBMP E-Khata certificate is issued with basically no problems.

5. Giving Updates

All through the registration process, we keep you informed at every step, outfitting you with regular updates and ensuring that you miss no deadlines or requirements.

6. Problem-Settling

Accepting that you face any challenges during the BBMP E-Khata registration, we step in to provide arrangements. From settling technical issues with the gateway to rectifying discrepancies in your documents, we are here to help.

Why Choose Khata Broker for Your E-Khata Needs?

At Khata Broker, we offer a range of services that go beyond helping you with the BBMP E-Khata registration. Here's the reason you should choose us:

Expert Team: Our team has extensive experience in property documentation, registration, and obligation matters, ensuring a smooth process for you.

Customer-Centric Methodology: We prioritize your convenience and want to provide hassle-free services tailored to your needs.

Transparency: We ensure all processes are clear, and you are completely informed about every step involved.

Quick and Efficient: We handle everything immediately, so you don't have to waste time obsessing about paperwork or registration issues.

Affordable Services: Our services are competitively priced to ensure that property registration remains an affordable process.

Conclusion

The BBMP E-Khata system has revolutionized property management in Bangalore, making the entire process of registration, documentation, and obligation payment easier and more transparent. By getting the E-Khata certificate, property owners can ensure that their property is legally recognized, secure, and free from disputes.

Whether you're buying, selling, or dealing with a property in Bangalore, understanding and completing the BBMP E-Khata process is imperative. Khata Broker is here to help you in every step of this journey, making it as seamless and hassle-free as could really be expected.

0 notes

Text

Important links for property document verification in bangalore

real estate document verification in Bangalore: 1. Property Title & Encumbrance Check Kaveri Online Services – Check Encumbrance Certificate (EC), sale deeds, and registration details. https://kaverionline.karnataka.gov.in/ 2. RERA Registration & Project Approvals Karnataka RERA – Verify if a project is legally approved. https://rera.karnataka.gov.in/ 3. Khata & Property Tax Status BBMP…

#BangaloreRealEstate PeripheralRingRoad BangalorePRR InfrastructureGrowth RealEstateInvestment PropertyTrends BangaloreDevelopment Ur#finance#investing#investment#passive-income#real-estate

0 notes

Text

GST Registration for Startups in Bangalore

Bangalore, known as the Silicon Valley of India, is a hub for startups, IT companies, and diverse business activities. With the rapid growth of businesses in the city, entrepreneurs and companies need to be aware of the Goods and Services Tax (GST) and the importance of GST registration. This article provides a detailed guide on GST Registration in Bangalore, including its benefits, eligibility, process, and required documents.

What is GST?

The Goods and Services Tax (GST) is a unified tax system that replaced various indirect taxes like VAT, excise duty, and service tax. It is levied on the supply of goods and services in India. GST is a destination-based tax, meaning it is collected at the point of consumption rather than the point of origin. The tax is divided into four categories:

CGST: Central Goods and Services Tax, collected by the Central Government.

SGST: State Goods and Services Tax, collected by the State Government.

IGST: Integrated Goods and Services Tax, levied on inter-state transactions.

UTGST: Union Territory Goods and Services Tax, applicable in Union Territories.

Why is GST Registration Important?

GST registration is mandatory for businesses with a turnover exceeding ₹40 lakhs (₹20 lakhs for service providers) or those involved in inter-state supply, e-commerce, or specific taxable services. GST registration allows businesses to:

Legally operate under the GST regime.

Claim input tax credit on purchases, reducing the overall tax burden.

Ensure compliance with tax regulations, avoiding penalties and legal consequences.

Enhance business credibility among customers and vendors.

Eligibility for GST Registration in Bangalore

GST registration is required for:

Businesses with annual turnover exceeding ₹40 lakhs (for goods) or ₹20 lakhs (for services).

Individuals and entities engaged in inter-state supply of goods or services.

E-commerce operators and those selling through online platforms.

Casual taxable persons are conducting occasional business.

Non-resident taxable persons providing goods or services in India.

Agents or distributors of taxable supplies.

Input service distributors.

Businesses are liable to pay reverse charges under GST.

Documents Required for GST Registration in Bangalore

To register for GST in Bangalore, companies need to provide the following documents:

PAN Card of the business or applicant.

Aadhaar Card of the authorised signatory.

Proof of business registration or incorporation certificate.

Identity proof and address proof of the authorised signatory (passport, driving license, or voter ID).

Bank account details, including a cancelled cheque or bank statement.

Address proof of the business premises (electricity bill, rent agreement, or property tax receipt).

Digital Signature Certificate (DSC) for companies and LLPs.

Photograph of the applicant (authorised signatory).

Steps for GST Registration in Bangalore

1. Visit the GST Portal

Go to the official GST portal at www.gst.gov.in and click on the “Services” tab. Under the "Registration" section, click on "New Registration."

2. Fill in the Details

Enter details like:

Business name and PAN.

Email address and mobile number.

Type of business (Proprietorship, LLP, Company, etc.).

3. Submit OTP Verification

An OTP (One-Time Password) will be sent to your registered mobile number and email. Enter this OTP to verify your details.

4. Fill in Business Information

Provide details like the business's legal name, trade name, principal place of business, and business constitution (LLP, partnership, etc.).

5. Upload Documents

Upload the required documents, including proof of business, identity, address, and bank details.

6. Digital Signature

If the business is a company or LLP, sign the application using a Digital Signature Certificate (DSC). Proprietorships and partnerships can use electronic verification codes (EVC).

7. Submit the Application

Once all details and documents are filled out, submit the application. After submission, you will receive an Application Reference Number (ARN) for tracking purposes.

8. GST Registration Certificate

The GST authorities will verify the application. If everything is in order, the GST registration certificate with a unique GST Identification Number (GSTIN) will be issued within seven working days.

GST Registration Fees in Bangalore

GST registration is free of cost. However, businesses may choose to hire professionals to assist with the process, which could involve a service fee depending on the complexity of the registration.

Penalties for Non-Registration

Failure to register for GST when required can result in penalties:

Late registration penalty: 10% of the tax amount due, subject to a minimum of ₹10,000.

Fraudulent evasion of tax: Penalty of 100% of the tax amount due.

Conclusion

GST Registration in Bangalore is essential for businesses to operate smoothly and comply with tax laws. It offers benefits like input tax credits and enhances a business's credibility. While the registration process can be completed online, it is crucial to ensure all details are accurate and documents are in place to avoid delays. If needed, consulting a professional can streamline the process.

0 notes

Text

What Is the Process for Getting a BBMP Trade License and Property Registration in Bangalore

Bangalore, often referred to as the Silicon Valley of India, is a bustling hub for businesses and real estate. Whether you’re starting a new venture or investing in property, understanding the regulatory processes is crucial. Two significant aspects you need to be aware of are obtaining a BBMP trade license certificate and navigating the property registration process in Bangalore. This guide will walk you through both processes, highlighting how Srimas Associate can assist you every step of the way.

Understanding the BBMP Trade License

A BBMP (Bruhat Bengaluru Mahanagara Palike) trade license is a mandatory requirement for businesses operating in Bangalore. This license ensures that your business complies with local laws and regulations. The BBMP issues trade licenses for various categories, including retail, manufacturing, and service-based industries.

Importance of a Trade License

Legal Compliance: Operating without a trade license can result in fines and legal issues.

Building Credibility: A trade license enhances your business's credibility in the eyes of customers and partners.

Access to Financial Services: Many banks and financial institutions require a trade license for loan applications.

Steps to Obtain a BBMP Trade License Certificate

Step 1: Determine the Type of License Required

Before applying, identify the type of trade license you need based on your business activities. The BBMP categorizes licenses based on the nature of the business, such as food services, retail, or manufacturing.

Step 2: Prepare Required Documents

Gather the necessary documents for the application. Commonly required documents include:

Proof of Identity: Aadhar card, passport, or voter ID.

Proof of Address: Utility bills or rental agreements.

Business Registration Certificate: If applicable, such as a partnership deed or company registration certificate.

NOC from the Landlord: If you’re renting the premises.

Site Plan: A layout of your business premises.

Step 3: Fill Out the Application Form

Visit the official BBMP website to download the application form for the trade license. Fill it out accurately with all required details.

Step 4: Submit the Application

Submit the completed application form along with the required documents to the BBMP office in your jurisdiction. Ensure that you keep a copy for your records.

Step 5: Pay the Fees

You’ll need to pay a fee for the trade license application. The fee varies depending on the type of business and your location within Bangalore. Payment can usually be made online through the BBMP portal or at designated banks.

Step 6: Inspection by BBMP Officials

Once your application is submitted, BBMP officials may conduct an inspection of your business premises to ensure compliance with safety and regulatory standards. Be prepared for this visit and ensure that all safety measures are in place.

Step 7: Receive Your Trade License

After successful verification and inspection, the BBMP will issue your trade license. You will receive a BBMP trade license certificate that you must display prominently at your business location.

Step 8: Renewal of the License

Trade licenses are typically valid for one year and need to be renewed annually. Keep track of the renewal date and submit your application on time to avoid penalties.

Importance of Property Registration

Legal Protection: Registered property provides legal evidence of ownership.

Financial Security: It is essential for obtaining loans and mortgages.

Transferability: Registered properties can be easily transferred or sold in the future.

Steps for the Property Registration Process in Bangalore

Step 1: Verify Property Documents

Before initiating the registration process, ensure that all property documents are in order. Key documents include:

Sale deed

Encumbrance certificate (EC)

Khata certificate

Tax payment receipts

Step 2: Pay Stamp Duty

Stamp duty is a tax imposed on property transactions and varies based on the property’s value and location. Calculate the stamp duty using the guidelines provided by the Karnataka government and pay it through designated banks or online.

Step 3: Prepare the Sale Deed

The sale deed is a legal document that transfers property ownership from the seller to the buyer. It should include details such as:

Names and addresses of both parties

Description of the property

Sale amount

Date of transaction

Step 4: Schedule Registration Appointment

Visit the local sub-registrar office to schedule an appointment for registration. You may also check if online appointments are available through the official website.

Step 5: Attend the Registration Appointment

On the scheduled date, both the buyer and seller must be present at the sub-registrar office. Bring the original documents, along with copies, to submit for verification.

Step 6: Sign the Sale Deed

Both parties will need to sign the sale deed in the presence of the sub-registrar. It’s essential to read the document carefully before signing to ensure all details are correct.

Step 7: Obtain Registration Certificate

After successful registration, you will receive a registration certificate. This document serves as proof of ownership and must be kept safe.

Step 8: Update the Land Records

Once the property is registered, ensure that the land records are updated to reflect the new ownership. This is crucial for future transactions and for obtaining a Khata.

How Srimas Associate Can Help You

Navigating the processes of obtaining a BBMP trade license certificate and completing the property registration process in Bangalore can be complex. This is where Srimas Associate comes in. Here’s how they can assist:

1. Expert Consultation

Srimas Associate offers professional consultation services to help you understand the requirements and steps for both trade licensing and property registration. Their team is well-versed in local regulations and can provide tailored advice.

2. Documentation Support

One of the most challenging aspects of licensing and registration is gathering and preparing the necessary documents. Srimas Associate can help ensure that all your paperwork is complete and correctly filled out, reducing the risk of delays.

3. Application Handling

The application process can be time-consuming. Srimas Associate can handle the submission of your trade license and property registration applications, ensuring that they are filed correctly and on time.

4. Compliance Assistance

Staying compliant with local laws is crucial for business operations. Srimas Associate provides ongoing support to ensure that you remain compliant with all regulations, including renewal of licenses and updating property records.

5. Post-Registration Services

After obtaining your trade license or registering your property, Srimas Associate continues to offer support in areas such as tax planning, legal advice, and financial services, ensuring that your business or investment remains secure.

Conclusion

Starting a business or investing in property in Bangalore involves understanding and navigating various regulatory processes. Obtaining a BBMP trade license certificate is essential for legal compliance, while the property registration process in Bangalore secures your ownership rights.

By following the steps outlined in this guide and seeking professional assistance from Srimas Associate, you can ensure a smooth and efficient process. With the right support, you can focus on growing your business or enjoying your new property, knowing that all legalities are handled properly. Embrace the opportunities that Bangalore has to offer, and take the first steps toward your entrepreneurial or real estate journey today!

0 notes

Text

Understanding the Benefits of a Short-Term Loan in Bangalore

Managing finances can be challenging, especially when you need quick funds. Short-term loans in Bangalore provide a convenient solution to meet immediate financial needs. Whether it’s a personal loan or a home renovation loan, understanding their features and benefits is essential.

What is a Short-Term Loan?

A short-term loan is a financial product designed to help you cover urgent expenses. These loans typically have a shorter repayment period, ranging from a few months to a year. They offer flexibility and fast approval, making them ideal for emergencies.

Advantages of Short-Term Loans in Bangalore

1. Quick Approval Process

Short-term loans are known for their speedy processing. Whether you need funds for a medical emergency or a sudden repair, the approval process is hassle-free and swift.

2. Flexible Repayment Options

Most lenders offer flexible repayment terms, allowing you to choose a schedule that suits your income. This feature makes managing your finances stress-free.

3. Accessible to Various Income Groups

Short-term loans are accessible to salaried employees, business owners, and even freelancers. Bangalore residents from diverse financial backgrounds can benefit from these loans.

Why Consider a Personal Loan in Bangalore?

A personal loan is an excellent option for those who require funds without restrictions on usage. Whether it's for a wedding, travel, or education, personal loans provide the financial freedom you need.

1. No Collateral Required

Personal loans are unsecured, meaning you don’t need to provide any asset as security. This makes them an attractive choice for individuals who lack significant collateral.

2. Competitive Interest Rates

With increasing competition among lenders in Bangalore, personal loans now come with competitive interest rates. Always compare rates to find the best deal.

Home Renovation Loans: Transforming Your Living Space

If your goal is to upgrade your home, a home renovation loan can provide the necessary funds. Bangalore's dynamic real estate market makes it essential to maintain and improve your property.

1. Tailored for Renovation Needs

These loans are specifically designed for remodeling, repairs, and upgrading your living space. From painting to structural changes, you can cover all expenses.

2. Tax Benefits

Home renovation loans often come with tax benefits under Indian tax laws. Consult a financial advisor to understand how you can maximize savings.

How to Apply for a Short-Term Loan in Bangalore

1. Research Lenders

Explore different financial institutions in Bangalore. Compare their interest rates, repayment terms, and eligibility criteria.

2. Prepare Necessary Documents

Ensure you have all required documents, such as identity proof, address proof, and income statements.

3. Submit Your Application

Apply online or visit the lender’s branch to complete the process. Many lenders now offer instant approvals and disbursals.

Tips for Managing Loan Repayments

Create a Budget: Allocate funds for monthly repayments to avoid defaults.

Set Payment Reminders: Use digital tools to stay on top of your EMI schedule.

Choose the Right Loan Amount: Borrow only what you can repay comfortably.

Short-term loans, personal loans, and home renovation loans in Bangalore are reliable options to manage your financial needs efficiently. By understanding their features and advantages, you can make informed decisions and secure your financial future.

#finance#personal loan#everydayloanindia#short term personal loan in india#cibil score#urgent loan#instant loan in delhi#personal loan in delhi

0 notes

Text

Tips for First-Time Buyers: Finding Plots on Doddaballapur Road

Doddaballapur Road has become a hot spot for first-time buyers in recent years. With its blend of growth potential, excellent connectivity, and affordability, it offers a unique opportunity for those looking to invest in real estate. As more people recognize its appeal, the area continues to attract attention, making it an exciting time for buyers.

However, first-time buyers often face challenges. Navigating the real estate market, identifying trustworthy sellers, and understanding complex legal processes can be overwhelming. The uncertainty can leave many feeling lost in their search for the KNS Group perfect plot.

This article aims to provide actionable tips to help first-time buyers successfully navigate the process of finding Plots for sale in Doddaballapur Road Bangalore.

Understanding the Doddaballapur Road Real Estate Market

Current Market Trends

The real estate market on Doddaballapur Road has shown promising trends in recent years. Property prices have seen steady appreciation, making it a wise choice for investment. Recent statistics indicate an average annual price increase of around 8-10%, with some areas even outperforming this average. Staying informed about these trends can empower buyers to make sound decisions.

Investment Potential

Experts project that Doddaballapur Road will continue its upward trajectory. The area's infrastructure development, including new roads and public transport facilities, enhances its appeal. These improvements are expected to boost property values over time. Investing now can lead to significant returns in the future.

Types of Plots Available

Buyers can choose from a variety of plots along Doddaballapur Road. Options range from small residential lots to larger parcels suited for commercial development. The availability of amenities, such as parks and schools, also varies by location. Buyers should assess their needs to find the right plot.

Setting Your Budget and Financial Planning

Determining Affordability

Before committing to a purchase, it's crucial to determine what you can afford. Factors like loan eligibility and down payment requirements will influence your budget.

Calculate your monthly income.

List your expenses.

Determine your savings for a down payment.

These steps will help you understand your financial limits.

Securing Financing

Several financing options exist for purchasing plots. Home loans are a common choice, but personal loans can also be viable. When seeking financing, comparing loan offers is essential to secure the best interest rates.

Hidden Costs

Don't overlook hidden costs that can add up quickly. Consider registration fees, property taxes, and development charges. Being aware of these expenses will help you better plan your budget.

Finding Reputable Sellers and Agents

Researching Sellers

Verifying seller legitimacy is vital in any real estate transaction. Use online resources and local networks to check for reviews and past transactions.

Working with Real Estate Agents

Engaging a real estate agent can simplify the buying process. Look for agents with strong local knowledge and positive client feedback. However, be aware of potential drawbacks, like commission fees.

Due Diligence

Before finalizing a purchase, thorough due diligence is necessary.

Verify land ownership.

Check for existing liens.

Ensure zoning laws allow your intended use.

A checklist can guide you through this process.

Navigating the Legal Aspects of Plot Purchase

Understanding Land Titles and Documents

Familiarizing yourself with different land titles is essential. Whether it's freehold or leasehold, understanding these types will help you know your rights as a buyer. Essential documents to consider include the sale deed, encumbrance certificate, and occupancy certificate.

Legal Verification Process

Seek legal counsel to verify land ownership and ensure a clear title. A lawyer can help you navigate this process, making it less daunting.

Registration and Transfer of Ownership

Plot registration and transferring ownership involve filing paperwork with local authorities. Make sure all documents are signed and dated properly to avoid future complications.

Tips for Negotiating and Closing the Deal

Negotiation Strategies

Negotiating the plot price can feel intimidating, but it’s a necessary step. Research comparable prices in the area to make informed arguments. Be confident and prepared to compromise on terms.

Making an Offer

When making a formal offer, clearly outline the price and any conditions. Transparency can help build trust with the seller.

Completing the Transaction

Finalize your purchase by ensuring all payments are made and ownership is transferred. Keep copies of all documents for your records.

Conclusion

Finding the right Plots in Doddaballapura Main Road doesn't have to be overwhelming. Key takeaways include understanding market trends, setting a realistic budget, and performing diligent research.

By staying informed and approaching the process methodically, first-time buyers can secure their dream property. Embrace the journey, and remember that thorough research will pay off in the end. Happy house hunting!

0 notes

Text

Top Documents Required for GST Registration in Bangalore

Goods and Services Tax (GST) registration is mandatory for businesses in India that meet certain turnover thresholds or engage in specific types of trade. This uniform tax system has streamlined indirect taxes across the country, reducing the complexity of multiple state and central taxes. Whether you're setting up a new business or expanding an existing one in Bangalore, getting your GST Registration in Bangalore accurately and on time is crucial to avoid legal issues and penalties.

List of Documents Required for GST Registration in Bangalore

Prakasha & Co., a leading GST registration consultant in Bangalore, specializes in helping businesses navigate the often-complicated GST registration process. With a wealth of experience in taxation and regulatory compliance, the experts at Prakasha & Co. ensure that your business is registered smoothly and efficiently. To make the process seamless, it’s essential to have all the required documents ready. In this blog, we will walk you through the top documents needed for GST registration in Bangalore.

1. Business Identity Proof

One of the first steps in the GST registration process is verifying the identity of the business and its owners. Depending on the type of business entity, the required identity documents may vary:

For Sole Proprietors: Aadhar card, PAN card, and copyright-sized photographs.

For Partnerships and LLPs: PAN cards of all partners, partnership deed, and photographs of partners.

For Private Limited Companies: PAN card of the company, Certificate of Incorporation issued by MCA, Memorandum and Articles of Association, and Director Identification Number (DIN) of directors.

These documents serve as the core proof of your business’s existence and its legitimacy.

2. Address Proofs of Business Premises

The GST authorities require you to provide proof of the address where your business operates. This ensures transparency and accuracy in tax filing. Acceptable documents include:

For Owned Property: Latest property tax receipt or a copy of the electricity bill in the business name.

For Rented Property: Rent agreement along with the electricity bill or lease agreement in the landlord's name.

For Virtual Offices: A NOC (No Objection Certificate) from the owner, along with utility bills in the owner’s name.

These address proofs are essential to ensure that your business’s physical location is correctly recorded with GST authorities.

3. Bank Account Details

You must submit proof of your business’s bank account for GST registration. This will include:

A copy of a canceled cheque or the first page of your bank passbook.

copyright reflecting your recent transactions.

These documents confirm the financial standing of your business and provide a formal channel for GST refunds and payments.

4. Business Constitution Certificate

For businesses like LLPs, companies, and societies, specific legal documents that define the structure of the organization must be provided. These include:

Partnership Deed for partnerships.

Certificate of Incorporation for companies, issued by the Ministry of Corporate Affairs.

Registration Certificate for societies or trusts.

Such documents prove the legal foundation of your business and are vital for GST compliance.

5. Authorization Form

If the GST application is being submitted by a representative, such as a director, partner, or proprietor, an authorization form or letter is required. This document grants the representative the legal right to apply on behalf of the business.

For companies and LLPs, this includes a resolution by the board of directors or the LLP partners, respectively, authorizing the representative to handle the GST registration.

6. Additional Documents (if applicable)

Depending on the nature of your business, certain other documents may also be required:

For Importers and Exporters: IEC (Import Export Code) certificate.

For E-commerce Operators: Legal documents related to online business operations.

For Special Economic Zones (SEZ): Additional SEZ certificates and approvals from the relevant authorities.

These specialized documents cater to niche industries, ensuring that businesses in such sectors comply with GST norms.

Conclusion

GST registration is a crucial compliance requirement for businesses operating in India, including those in Bangalore. Ensuring that all necessary documents are in place will make the process swift and error-free. At Prakasha & Co., the team of experienced GST consultants in Bangalore can guide you through every step of the registration process, ensuring full compliance with GST regulations. With their professional expertise, you can rest assured that your business is in good hands.

1 note

·

View note

Text

Finding Your Perfect Residential Plot in Mysore Road: A Simple Guide

When you’re on the hunt for a Best residential plot in mysore road bangalore, it can feel a bit overwhelming. With so many choices, where do you even start? Don’t worry! We’ve got your back with this easy-to-follow guide. Let’s jump right into it and find that Ksquare Home dream plot together.

Understanding Mysore Road: The Basics

Mysore Road is a bustling area located just outside Bengaluru. Known for its mix of urban and natural beauty, it attracts families, professionals, and investors alike. So, why is this area so popular? It offers excellent connectivity to the city center while still retaining a peaceful vibe. Imagine living near the action but enjoying a quiet retreat at home—sounds perfect, right?

Assessing Your Needs: What’s Important to You?

Before you start your search, take a moment to think about what you really want. Do you need proximity to schools, hospitals, or shopping centers? Maybe a spacious garden for your kids or pets? Jot down your must-haves and nice-to-haves.

Location

The plot’s location can make all the difference. Look for areas that feature good roads for easy travel and nearby amenities. Ask yourself: “Is the location convenient for my daily life?” A little research here can save you a lot of time later.

Researching the Neighborhood: More Than Just a Plot

While finding the right plot is essential, the neighborhood plays an equally important role. Check out local parks, restaurants, and community events. You want to feel at home, right?

Safety and Comfort

Safety is a top priority. Check crime rates and talk to locals about their experiences in the area. A friendly neighborhood can transform a simple plot into a home.

Financial Factors: Budgeting Right

Now that you have a list of what you want, it’s time to talk numbers. How much are you willing to spend? Keep in mind that prices vary based on location and amenities.

Hidden Costs

Don’t forget about additional costs like registration fees, property taxes, and maintenance charges. Looking into these will help prevent unwelcome surprises down the road.

Finding the Right Real Estate Agent

Navigating the Ksquare Homes real estate market can be tricky. A knowledgeable agent can guide you through the process and help you find listings that match your criteria. They can also provide insights into the local market that you might not find online.

Building Trust

Make sure to choose someone you feel comfortable with. A good agent listens to your needs and keeps you informed every step of the way.

Site Visits: Don’t Skip This Step

After narrowing down your options, it’s time to hit the road for some site visits. Walking through the Sites near Mysore Road Bangalore will give you a feel for the area and help you visualize your future home.

Picture Yourself There

As you walk through each plot, imagine your life there. Will your kids enjoy playing outside? Is there enough room for your dreams? This is your chance to picture your future.

The Final Decision: Sealing the Deal

Once you’ve found the perfect plot, it’s time to make an offer. Be prepared for some negotiation; it’s a normal part of the process. Work closely with your real estate agent to ensure everything goes smoothly.

Closing the Deal

Finalizing the paperwork and transferring ownership can feel a bit daunting, but it’s all part of the journey. Make sure to double-check everything to ensure you’re making a sound investment in your future.

Conclusion: Your Dream Plot Awaits!

Finding the best residential plot on Mysore Road isn’t just about the land; it’s about creating a life you love. With a clear plan, good research, and a bit of patience, you’ll be standing on your new property before you know it. So, roll up your sleeves, get out there, and let your dream home become a reality!

0 notes

Text

How to Register a Sole Proprietorship in Bangalore

A sole proprietorship company is owned and operated by a single individual and is typically established within a quick 15-day timeframe. It often emerges in an unorganised sector among merchants or small business proprietors. A notable advantage is the absence of a mandatory registration process, including the exemption from GST registration. However, it's essential to note that the liability in a Sole Proprietorship Company is unlimited. This type of business registration, particularly Sole Proprietorship Registration in Bangalore, is a prevalent choice in our country.

Simplified procedure to guide you through the process:

1. Business Name Selection:

Choose a unique and suitable name for your Sole Proprietorship. Ensure it meets the guidelines and availability criteria.

2. Document Preparation:

- Gather necessary documents, including:

- PAN card of the proprietor

- Aadhar card of the proprietor

- Address proof (utility bills, rental agreement, etc.)

- Passport-size photographs

- Canceled cheque or bank statement

3. Registration Form Filling:

- Visit the official website for business registration in India.

Please Complete the required online registration form with accurate details. Provide the business name, proprietor's details, business address, and other relevant information.

4. Submit Documents:

- Upload scanned copies of the necessary documents per the platform's requirements.

5. Payment of Fees:

You can pay the registration fees online through the designated payment gateway. The costs may vary depending on the services and features you choose.

6. Verification Process:

- After submitting the application and documents, the registration authority will review and verify the details provided.

7. Acknowledgment and Application Status:

- Once the verification is complete, you will receive an acknowledgement or an application reference number. Use this to track the status of your application.

8. Certificate Issuance:

- The authorities will issue the Sole Proprietorship registration certificate upon successful verification. This document serves as proof of your business's legal existence.

9. Business Bank Account:

- Open a business bank account using the registration certificate and other relevant documents.

10. Compliance Requirements:

Familiarise yourself with local and national compliance requirements. If your business turnover exceeds the threshold, this may include obtaining a Goods and Services Tax (GST) registration.

11. Post-Registration Formalities:

- Display the registration certificate at your business premises. Ensure you comply with all regulatory requirements to run your Sole Proprietorship smoothly.

Consult with a professional or use government-approved portals for a smooth and error-free registration process. However, as government regulations may change, the specifics may vary, so always refer to the latest guidelines.

Documents Required for Sole Proprietorship Company Registration in Bangalore

The specific documents required for Sole Proprietorship Company Registration in Bangalore may vary based on local regulations and the nature of your business. However, generally, the following documents are commonly needed:

1. Identity Proof of Proprietor:

- PAN card of the proprietor

2. Address Proof of Proprietor:

- Aadhar card of the proprietor

- Passport, voter ID, or driver's license

3. Passport-size Photographs:

- Recent passport-sized photographs of the proprietor

4. Business Address Proof:

- Utility bills (electricity, water, or gas bill) of the business premises

- Rental agreement, if the property is rent

5. Bank Documents:

- Canceled cheque or bank statement in the name of the proprietor and the business

6. Registration Application Form:

- Duly filled registration form with accurate details

7. Additional Documents:

- Any other documents required by the local registering authority or as per specific business activities

It's advisable to check with the local authorities or consult a professional to ensure you have all the necessary documents for Sole Proprietorship Company Registration in Bangalore. Additionally, the process and required documents may be subject to updates in government regulations, so staying informed about the latest requirements is crucial for a smooth registration process.

Conclusion:

Proprietorship Registration in Bangalore offers a straightforward and efficient avenue for individuals venturing into small businesses. The process, typically completed within a quick 15-day timeframe, requires carefully considering the business name, gathering essential documents, and navigating through an online registration form. The unique advantage lies in the exemption from mandatory GST registration, making it an appealing choice for merchants and small business owners. However, it's crucial to acknowledge the unlimited liability inherent in a Sole Proprietorship Company.

The outlined step-by-step procedure provides a practical guide for the registration process, emphasising the importance of compliance with local and national regulations. To ensure a smooth and error-free registration, consulting with professionals or utilising government-approved portals is recommended, as well as adapting to any updates in government regulations for an informed and seamless registration experience in Bangalore.

0 notes

Text

Property Registration in Bangalore: A Complete Guide by Srimas Associate

Property registration is an essential aspect of real estate transactions, especially while you're buying or selling a property. For those looking to get property proprietorship in Bangalore, understanding the property registration process is crucial. Whether you are purchasing a residential apartment or a commercial space, getting your property legally enlisted guarantees your possession freedoms are legally perceived. In this guide, we'll break down the course of property registration in Bangalore, explain apartment registration charges, and introduce Srimas Associate, a believed name in real estate administrations in the city.

Understanding Property Registration in Bangalore

Property registration in Bangalore is the formal cycle where the responsibility for property is legally recorded by the authorities. This cycle is managed by the sub-registrar workplaces across various districts of the city. The importance of property registration cannot be overstated, as it gives a legal safeguard to your possession privileges. At the point when you register your property, it turns into an openly available report, offering transparency and clarity in real estate transactions.

Prior to proceeding with the registration, it's important to guarantee that the property reports are accurate and complete. The registration cycle typically involves the following key stages:

Verification of Records: Prior to heading to the sub-registrar's office, you want to guarantee that all necessary archives like the Sale Deed, personality evidence, address confirmation, and property-related reports are in request.

Stamp Obligation Payment: One of the most important phases in property registration is paying the stamp obligation, which is a mandatory tax forced by the state government. The stamp obligation varies based on the location of the property, its market value, and different factors.

Property Valuation: The market value of the property is assessed, which determines the stamp obligation you want to pay. This is done either by the sub-registrar or through an authorized evaluator.

Accommodation of Archives: Whenever you have gathered the necessary records, submit them to the sub-registrar's office for verification and registration.

Signature and Biometrics: Both the purchaser and dealer should be available at the sub-registrar's office. Signatures are taken on the Sale Deed, and biometrics are recorded to complete the cycle.

Receiving the Enrolled Deed: After the archives are checked, the property registration process is complete. You will get an enlisted Sale Deed, which is the official report proving your responsibility for property.

Apartment Registration Charges in Bangalore

While buying an apartment, the registration charges in Bangalore are crucial to remember. These charges include both stamp obligation and registration expenses.

Stamp Obligation: The stamp obligation in Bangalore is determined by the market value of the property or the transaction value, whichever is higher. For residential properties, stamp obligation is typically 5% of the total property value, while for commercial properties, it may vary.

For Ladies Purchasers: now and again, there are diminished stamp obligation rates for ladies purchasers. The stamp obligation could be 3.5% for ladies, making it more affordable for ladies investors in Bangalore.

Registration Charges: In addition to the stamp obligation, there is a registration expense, which is typically 1% of the total market value of the property. This expense is mandatory and ought to be paid at the hour of registration.

Additional Charges: You may also experience different charges like record verification charges and legal expenses. These charges vary depending on the intricacy of the records involved and the legal necessities for your particular transaction.

Guidelines for Determining Charges: The Karnataka government gives an online framework where you can check the property value and determine the stamp obligation and registration charges. The framework calculates the charges based on various parameters, for example, location, property type, and transaction value.

Why Pick Srimas Associate for Property Registration?

Navigating the property registration process in Bangalore can be perplexing, however with the assistance of a believed real estate partner like Srimas Associate, you can guarantee a smooth and sans hassle insight. Srimas Associate is a leading name in Bangalore's real estate area, specializing in property registration administrations.

The following are a couple of reasons why Srimas Associate is the favored decision for property registration in Bangalore:

Mastery in Real Estate Transactions: Srimas Associate has years of involvement with handling property registration processes, ensuring that all documentation and methods are handled proficiently and accurately.

Transparent Charges: With Srimas Associate, you don't have to stress over secret expenses. The company gives a clear breakdown of all registration charges forthright, including stamp obligation, registration expenses, and any additional charges. This assists you with planning your financial plan with practically no curve balls.

Assistance with Record Verification: Ensuring that your reports are in request is crucial for effective property registration. Srimas Associate assists in reviewing and verifying your reports to guarantee that everything is in compliance with legal prerequisites.

Start to finish Backing: From the second you choose to purchase a property until the registration is complete, Srimas Associate offers full help. They guide you through each step of the cycle, making the whole experience seamless and sans hassle.

Legal Mastery: Srimas Associate's team includes legal specialists who can assist with resolving any legal issues that may arise during the property registration process. Whether it's a disagreement regarding property titles or legal documentation, the team guarantees that all legal aspects are handled successfully.

Personalized Help: Srimas Associate understands that each property transaction is extraordinary. They offer personalized types of assistance tailored to your particular necessities, ensuring that the property registration process is aligned with your prerequisites.

Convenient Execution: One of the greatest worries while dealing with property registration is time. Srimas Associate guarantees that the registration interaction is completed on time, so you can partake in the peace of mind knowing your property is legally gotten.

Normal Issues During Property Registration and How Srimas Associate Makes a difference

While property registration is a straightforward interaction, there are several challenges that property purchasers and merchants may experience. The following are a couple of normal issues that may arise and how Srimas Associate can help:

Discrepancies in Property Archives: Once in a while, property records may have discrepancies, for example, incorrect details about the proprietor or property size. Srimas Associate's legal team distinguishes and resolve these issues prior to proceeding with registration.

Delayed Payments: In the event that you fail to pay the stamp obligation or registration charges on time, your registration cycle may be delayed. Srimas Associate guarantees that all payments are made instantly to avoid delays.

Disagreements about Property Titles: Possession debates are normal in property transactions. Srimas Associate explains property titles and offers legal assistance to determine any proprietorship questions.

Verification of Property's Market Value: Once in a while, the market value of the property may be challenged, resulting in a higher stamp obligation. Srimas Associate guarantees that the property valuation is accurate and aligns with current market patterns.

Advantages of Property Registration in Bangalore

There are various advantages to registering your property in Bangalore, some of which include:

Legal Security: Property registration gives legal insurance to the purchaser. When the property is enlisted, your proprietorship privileges are legally perceived, reducing the gamble of property debates.

Freely available report: Enrolled properties become part of the openly available report, which guarantees that your possession details are transparent. This aides in case of any future legal or financial matters related to the property.

Further developed Property Value: Properties with legitimate registration have a higher value and are easier to sell or mortgage later on. Registration adds to the validity and marketability of your property.

Ease of Transfer: When the property is enrolled, the transfer interaction turns out to be a lot more straightforward. Whether you're buying or selling, enlisted properties are easier to transfer, and the cycle is faster.

Access to Financing: Enlisted properties are qualified for loans, and banks are bound to offer financing for enrolled properties. This opens up additional choices for potential purchasers who wish to take out a loan.

Conclusion

Property registration in Bangalore is a critical stage in securing your property possession. Whether you're buying an apartment or a commercial property, registering the property guarantees that your possession is legally perceived and secured. While the cycle could appear to be mind boggling, with the assistance of specialists like Srimas Associate, you can navigate it easily.

Srimas Associate offers reliable, transparent, and effective property registration administrations in Bangalore. Their team of professionals guarantees that your property transaction is completed with no legal obstacles or delays. With their aptitude, you can be assured that your property registration is in great hands.

0 notes

Text

Guide to Buying an Independent House for Sale in Bangalore

Bangalore, a city that's rapidly expanding, offers a unique blend of urban convenience and serene living. For many, owning an independent house is the ultimate dream. But navigating the Bangalore real estate market can be overwhelming. Let's break down the process into simpler steps.

Understanding the Bangalore Real Estate Market

Bangalore's real estate market is a dynamic landscape shaped by various factors. Understanding these nuances is crucial for making informed decisions.

Location: The city is divided into several micro-markets, each with its own unique character and price range. Areas like Whitefield, Electronic City, HSR Layout, and Indiranagar are established residential and commercial hubs, offering excellent infrastructure and connectivity. These areas typically come with a premium price tag due to high demand.

On the other hand, emerging areas in North and South Bangalore are witnessing rapid development, offering a mix of affordable and upscale options. Factors like proximity to IT parks, educational institutions, healthcare facilities, and public transportation play a significant role in determining property values.

Price Trends: Real estate prices in Bangalore have shown consistent growth over the years. However, the pace of appreciation varies across different localities. It's essential to research current market trends, compare prices per square foot, and analyze historical data to gauge potential investment returns.

Lifestyle Preferences: Your lifestyle preferences should also influence your location choice. If you prioritize a peaceful environment, consider areas with ample green spaces and low-density developments. For those seeking a vibrant lifestyle, proximity to shopping malls, restaurants, and entertainment options might be a priority.

Defining Your Needs and Budget

Before embarking on your house hunt, clearly define your requirements and establish a realistic budget. Consider the following factors:

● Size and layout: Determine the number of bedrooms, bathrooms, living spaces, and other rooms necessary to accommodate your family's needs and lifestyle. Consider the long-term, such as potential family growth or aging in place.

● Location and amenities: Prioritize areas based on proximity to your workplace, children's schools, hospitals, and other essential amenities. Consider the availability of public transportation, parks, recreational facilities, and shopping centers.

● Budget: Set a realistic budget for the property purchase, including the cost of the house, registration charges, and potential renovation expenses. Factor in additional costs such as property taxes, maintenance fees, and utilities.

● Lifestyle and preferences: Consider your desired lifestyle and preferences. Do you prioritize a quiet neighborhood, proximity to nature, or a vibrant community? Research the amenities and facilities available in different areas.

By carefully considering these factors, you can create a detailed profile of your ideal home and narrow down your search accordingly.

Finding the Right Property

Your search for an independent house in Bangalore involves several avenues:

Online Platforms: Websites like gravityhomes.in offer extensive listings, allowing you to filter properties based on your preferences. You can browse through images, descriptions, and virtual tours to get a preliminary idea.

Real Estate Agents: Local real estate agents possess in-depth knowledge of the market and can provide personalized assistance. They can help you find properties that match your criteria, schedule viewings, and guide you through the negotiation process.

Direct Search: Visiting neighborhoods you prefer can be fruitful. You might discover properties not listed online. Look out for "for sale" signs, inquire with local residents, or explore upcoming projects.

Networking: Leverage your social and professional networks. People might know about properties available for sale, even if they aren't officially listed.

Building Relationships: Establishing connections with builders, developers, and property owners can provide early access to new projects or off-market opportunities.

Open Houses and Property Exhibitions: Attend property exhibitions and open houses to explore various options and gather information from developers and sellers.

Consider Different Property Types: While focusing on independent houses, keep an open mind about other options like villas, bungalows, or townhouses. They might offer similar benefits with variations in space, privacy, and maintenance requirements.

Financial Institutions: Some banks and financial institutions have tie-ups with builders and offer exclusive property listings to their customers.

By combining these approaches, you increase your chances of finding the perfect independent house that meets your needs and budget.

Due Diligence: Essential Checks

Once you find a potential property, conduct thorough checks:

● Property verification: Ensure the property is legally owned and free from disputes.

● Title deed verification: Verify the ownership history to avoid legal issues.

● Physical inspection: Check the property's condition, including structural integrity, plumbing, and electrical systems.

● Amenities and infrastructure: Assess the availability of water, electricity, drainage, and other essential services.

● Legal and taxation aspects: Consult a lawyer to review the property documents and understand tax implications.

Negotiation and Booking

Once satisfied with the property, initiate negotiations:

● Price negotiation: Discuss the price with the seller, considering market rates and property conditions.

● Booking amount: Pay a booking amount to secure the property, as per the agreement.

● Agreement: Sign a sale agreement outlining terms and conditions.

Home Loan and Financial Planning

Most people require a home loan to purchase a house.

● Eligibility: Check your eligibility for a home loan based on income and credit score.

● Compare lenders: Explore different lenders to find the best interest rates and terms.

● Down payment: Arrange for the required down payment.

● Stamp duty and registration charges: Factor in these additional costs.

Legal Procedures and Possession

Completing the legal formalities is crucial:

● Loan disbursement: Once the property is approved, the lender disburses the loan amount.

● Registration: Register the property in your name at the sub-registrar's office.

● Possession: Obtain possession of the property after completing all legal formalities.

Post-Purchase Considerations

After moving in, consider these aspects:

● Home insurance: Protect your investment with adequate insurance coverage.

● Interior design: Plan your home's interior design to match your preferences.

● Maintenance: Regular maintenance is essential to preserve your property's value.

Additional Tips

● Trust your instincts: Rely on your gut feeling when making decisions.

● Seek professional advice: Consult lawyers, real estate agents, and financial advisors.

● Patience is key: Finding the perfect home might take time.

● Negotiate wisely: Be firm but fair during negotiations.

● Emergency fund: Keep a financial cushion for unexpected expenses.

Gravity Homes

Gravity Homes is a renowned real estate developer in Bangalore, renowned for its commitment to crafting exceptional living spaces that seamlessly blend luxury, comfort, and sustainability. With a vision to redefine the residential landscape, Gravity Homes has been creating projects that resonate with the aspirations of modern homeowners.

Gravity Homes boasts a diverse portfolio of residential projects that cater to different lifestyles and preferences. From luxurious villas to thoughtfully designed apartments, each project is a testament to the developer's commitment to excellence.

Our Projects:

● Gravity Smera Gardens: This project offers a unique blend of nature and luxury, with spacious villas surrounded by lush greenery. Residents can enjoy the tranquility of their private backyard gardens while being connected to the city's conveniences.

● Gravity Lake Estates: A harmonious fusion of nature and urban living, this project provides residents with a serene retreat amidst the bustling city. Modern amenities and a strong focus on sustainability make it an ideal choice for those seeking a balanced lifestyle.

● Gravity Aranya: A haven of tranquility nestled amidst lush greenery, Gravity Aranya offers a unique opportunity to experience the beauty of nature while enjoying the comforts of modern living. This project features spacious villas with private gardens, providing residents with a serene escape from the hustle and bustle of city life. With a strong emphasis on sustainability and eco-friendly practices, Gravity Aranya offers a truly exceptional living experience.

0 notes

Text

Expert ITR Filing for Capital Gains on Property in Bangalore | SK Tax Law Firm Ensure seamless and accurate ITR filing for capital gains on property in Bangalore with SK Tax Law Firm. Our experienced professionals provide comprehensive tax solutions, ensuring compliance and maximizing your tax benefits. Contact us today for expert advice and hassle-free filing.

0 notes

Text

What is ITR-2 form: How to file ITR-2 FY 2022-23 (AY 2023-24) - Tax Craft Hub

The ITR-2 form is an Income Tax Return form used by individuals and Hindu Undivided Families (HUFs) in India who do not have income from business or profession, but have income from salary/pension, house property, capital gains, foreign assets/income, and other sources. To file ITR-2 for FY 2022-23, gather necessary documents such as PAN card, Aadhaar card, bank details, Form 16, Form 26AS, and investment proofs. You can file online via the Income Tax e-Filing portal or offline by downloading the form utility, filling it, generating an XML file, and uploading it. After filling in personal, income, tax, and deduction details, validate the form, compute the tax, and submit it. Finally, verify the return electronically or by sending a signed ITR-V to the CPC Bangalore within 120 days. For More Information About What is ITR-2 Form

0 notes

Text

Consequences of Not Registering for GST in Bangalore

Simplifying the GST Registration Process for Businesses in Bangalore

Introduction:

Goods and Services Tax (GST) has streamlined the taxation system in India, unifying various indirect taxes into a single framework. GST Registration in Bangalore is a legal requirement for businesses and a gateway to seamless compliance and improved tax management. This article aims to simplify the GST registration process, guiding companies through the necessary steps to ensure compliance and operational efficiency.

Understanding GST Registration:

GST registration is mandatory for businesses whose annual turnover exceeds the prescribed threshold limit, which is currently set at Rs. 20 lakhs for most states in India. However, specific categories of businesses, such as those involved in interstate transactions or supplying goods and services through e-commerce platforms, must register for GST, irrespective of their turnover.

Key Documents Required:

Before initiating GST registration in Bangalore, businesses must gather essential documents. These typically include:

1. PAN Card of the Business: The Permanent Account Number (PAN) is a fundamental requirement for GST registration.

2. Proof of Business Registration: This could be a Partnership Deed, Certificate of Incorporation, or any other relevant document.

3. Address Proof: Documents such as rent agreements, electricity bills, or property ownership documents prove the business address.

4. Identity and Address Proof of Proprietor/Partners/Directors: Aadhar card, passport, voter ID, or driver's license can be submitted.

5. Bank Account Details: Provide bank account information for the business entity.

6. Digital Signature: Some businesses may require a digital signature for online GST registration.

Online Application Process:

The GST registration process is primarily conducted online through the GST portal. Businesses need to follow these steps:

1. Visit the GST Portal: Access the official GST portal (https://www.gst.gov.in/) and navigate the registration section.

2. Create an Account: If you still need to register, create an account on the GST portal using valid credentials.

3. Fill out the Registration Form: Complete the GST registration form (Form GST REG-01) with accurate information and upload the necessary documents.

4. Submission: After completing the form and attaching the required documents, apply online through the GST portal.

5. Verification and Approval: The GST authorities will verify the application and documents submitted. Upon successful verification, a GST registration certificate will be issued.

Receiving GSTIN and Compliance:

Once the application is approved, the business will receive a unique Goods and Services Tax Identification Number (GSTIN). This GSTIN is essential for all GST-related transactions, including invoicing, filing returns, and claiming input tax credits.

After obtaining GSTIN, businesses in Bangalore must ensure ongoing compliance with GST regulations. It includes timely filing of GST returns, maintaining proper records of transactions, issuing tax invoices per GST guidelines, and adhering to other compliance requirements stipulated under the GST law.

Conclusion:

GST Registration in Bangalore is a fundamental step for businesses to comply with tax regulations and unlock the benefits of seamless tax administration. By understanding the registration process and fulfilling the requirements, companies can ensure compliance, streamline operations, and contribute to the economy's growth. Embracing GST registration enhances transparency and accountability and fosters a business environment conducive to sustainable growth and development.

0 notes